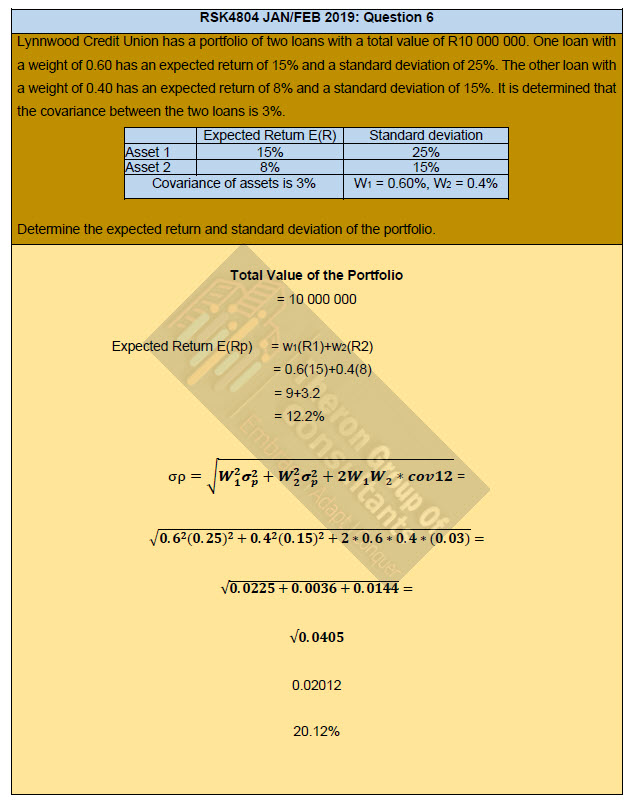

Lynnwood Credit Union has a portfolio of two loans with a total value of R10 000 000. One loan with a weight of 0.60 has an expected return of 15% and a standard deviation of 25%. The other loan with a weight of 0.40 has an expected return of 8% and a standard deviation of 15%. It is determined that the covariance between the two loans is 3%. Determine the expected return and standard deviation of the portfolio.

Correlation of the assets in the portfolio

This statistic quantifies the degree to which two variables move in the same direction. Correlation coefficients range from +1 (perfect positive correlation) to –1 (perfect negative correlation). Take note that the correlation coefficient is a very positive 0.978. Although the covariance measures the degree to which returns on two risky assets move in tandem, it does not explain the strength of the relationship, which is then measured by the correlation coefficient.

A correlation coefficient of 0 shows that the two variables are unrelated. When P and Q move in near-perfect synchronization, a near-perfect positive correlation exists. In practice, this event would be extremely rare.