Portfolio Risk Measurement

The variance and standard deviation of returns are alternative statistical measures that are used for measuring risk in an investment. These statistics measure the extent to which returns are expected to vary around an average over time. Standard deviation is the deviation of a portfolio return from the mean return. CFA Institute Investment Foundations®, Third Edition – Chapter 19

Covariance and Correlation of coefficient

Covariance measure the interactive risk within a portfolio. It measures, how returns vary with each other in a portfolio. Kasilingam, (n.d.) articulated the concept of portfolio risk in terms of the interactive risk between securities. The riskiness of each asset in the portfolio is measured to come up with the overall portfolio risk. Interactive risk deals with the direction in which returns of an asset move with other securities which constitute the portfolio, and this measured in terms of the covariance.

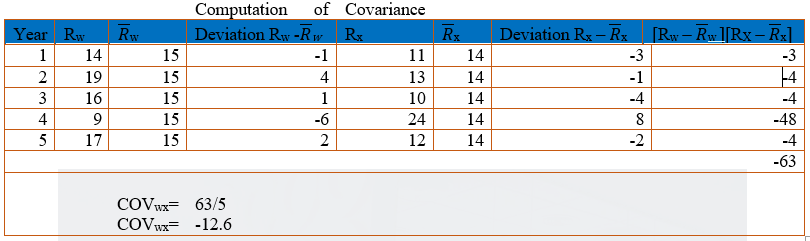

Example

| Year | Returns from security W | Returns from security X |

| 1 | 14 | 11 |

| 2 | 19 | 13 |

| 3 | 16 | 10 |

| 4 | 9 | 24 |

| 5 | 17 | 12 |

From the above information calculate the covariance of security W and X.

Solution

Interpretation of Covariance.

- If returns on a security move in the same direction consistently the COVwx will the positive

- If returns move in the opposite direction consistently COVwx will be negative

- If there is no relationship in the movement of returns COVwx is zero.

Bibliography

- CFA Institute Investment Foundations®, Third Edition – Chapter 19

- Kasilingam, D.R., n.d. Reader, Department of Management Studies, Pondicherry University Puducherry 292.