Systematic and Unsystematic risk.

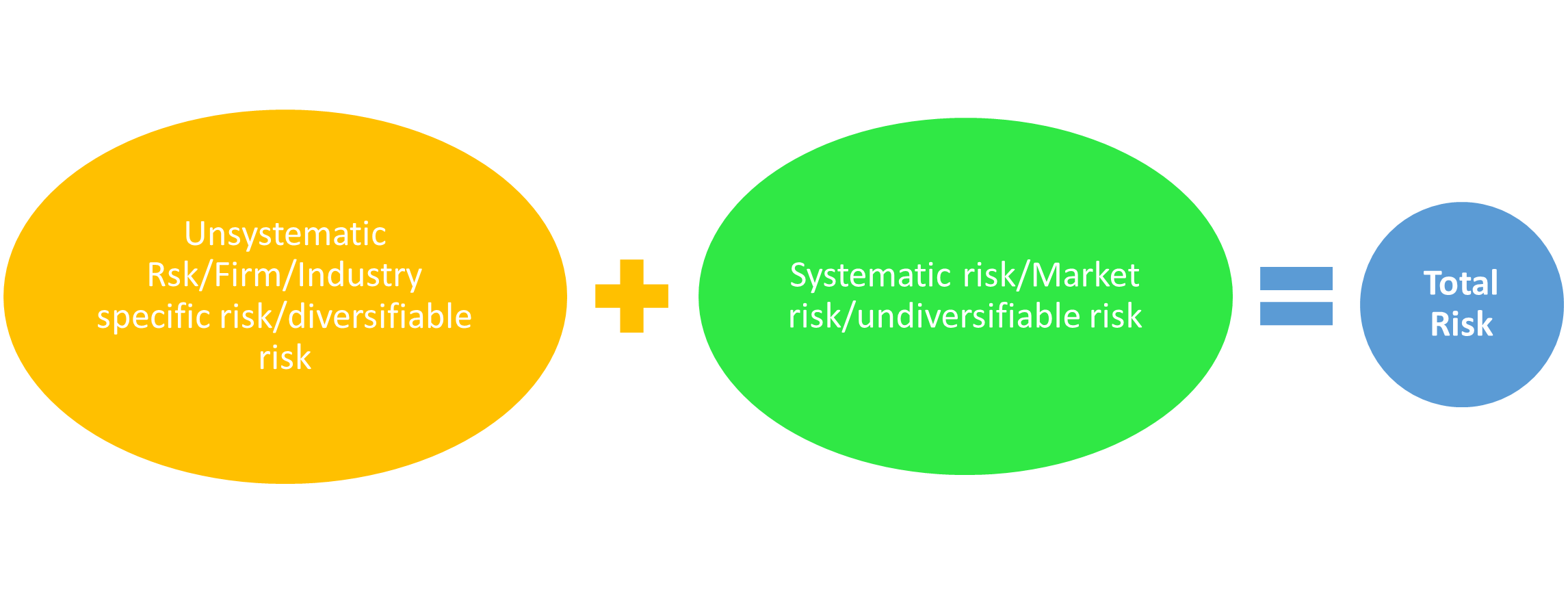

According to Akrani, (n.d.) systematic is undiversifiable risk or uncontrollable risk. It is macro as it influences the whole economy. A firm or industry has no control over systematic risk. In this paper we are concerned with market risk which is systematic risk because we cannot diversify it, spreading our investment across the different sectors will not curb market risk. In this discussion, we shall assume that all market risk is a financial risk but not all financial risk is market risk. This is because credit risk is a financial risk but not a market risk.

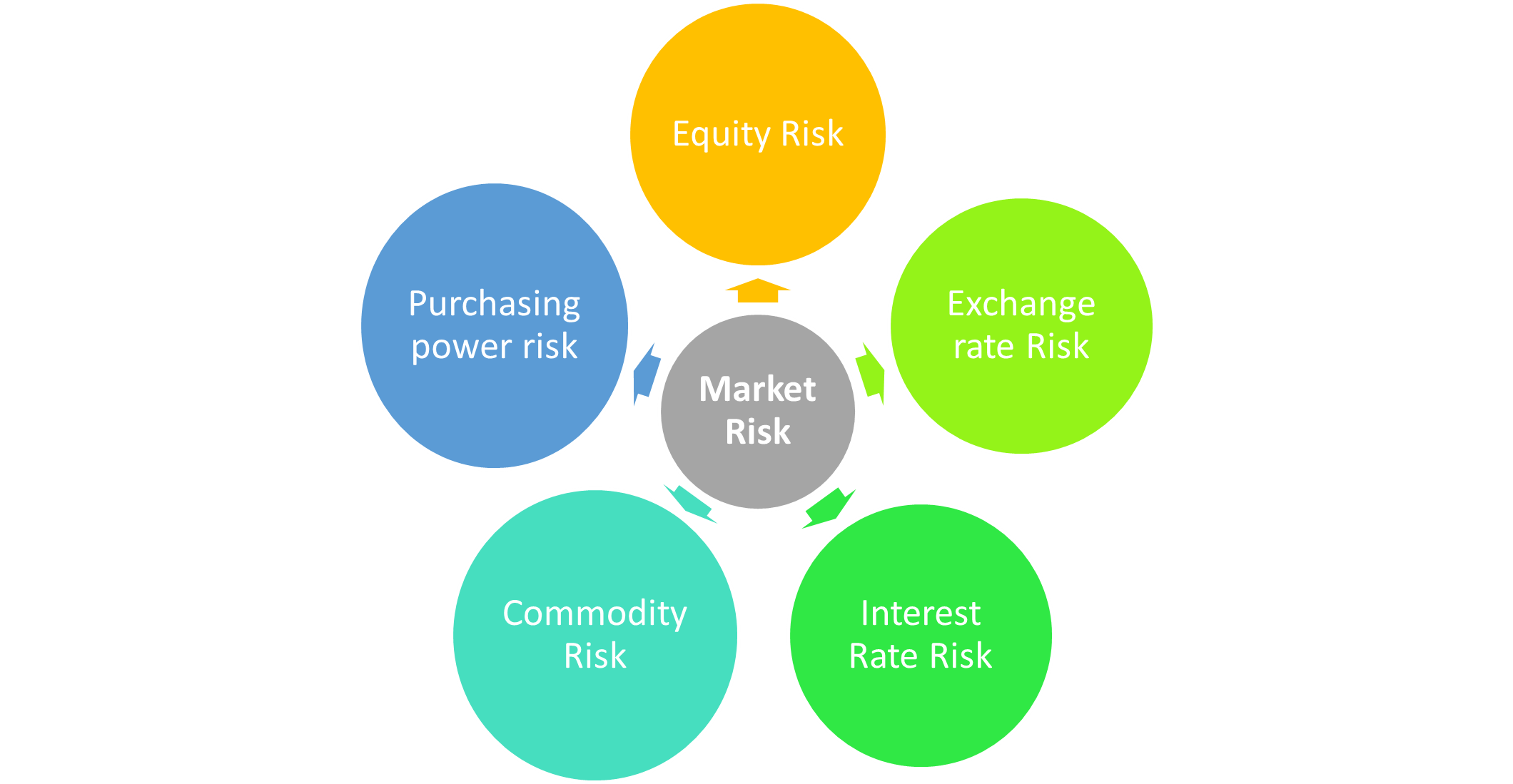

As we explained above that we shall consider all market risk to be financial, the above diagram illustrates market risk. It is essential to understand market risk may involve some non-financial risks which include but not limited to natural disasters, famine, war and political instability.

Unsystematic Risk / Idiosyncratic risk

According to (Howard, n.d.) unsystematic risk is unique to a specific asset or investment. Unsystematic risk is the risk that is associated with a particular firm or industry, hence it is called firm-specific risk. This form of risk can be diversified and controlled. Since unsystematic risk affects a particular industry it, therefore, means if we can invest funds in different industries we can do away with the impact of systematic risk.

If the South African Reserve Bank introduced a new law through its regulatory agencies which we shall cover later, maybe restricting banking institutions to take deposits of more than R20 000 from individual customers, this will specifically affect the financial sector primarily banks, the health sector, agricultural sector, mining sector and other sectors are not affected. Therefore we can conclude that unsystematic risk is security, firm or industry-specific risk which can be managed by spreading our investments across different sectors of the economy. Unsystematic risk includes liquidity risk, credit risk, industry up and down swings, employee strikes, operational risk, system failures. If ABC bank`s employees go on strike will that affect the operation of ABSA bank ?. No, it is a firm-specific risk it will affect the respective bank.

Bibliography

Akrani, G., n.d. Types of Risk – Systematic and Unsystematic Risk in Finance. URL https://kalyan-city.blogspot.com/2012/01/types-of-risk-systematic-and.html (accessed 3.4.21).

Howard, M., n.d. Accounting for unsystematic risk 3.