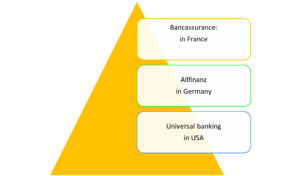

Full-service financial firms

The term bancassurance is common in France, which means the integration of financial services. The developments in the financial service industry which resulted in the financial institutions providing a wide range of financial products integrating banking and insurance is called Allfinanz, (Schüler, 2004). The terms Bancassurance, Allfinanz and Universal banking are used interchangeably though universal banking is more defined in terms of the convergence between commercial and investment banking. The development of banks into full-financial services firms have attracted more attention as it resulted in a conflict of interests.

Advantages of Bancassurance

Convenience

Convenience topped the rank on the advantages of bancassurance to customers. Buying an insurance product from the bank provides a wide number of benefits from customisation of the products and reduced fees, (Meenu, 2019). This will also depend on the level of relationship with the bank. Relationship banking involves a situation in which long-serving and loyal customers receive benefits from the mutual relationship which exist between them and the bank. Johan (2016) alluded that banks ought to make the transition from transactional to relationship-based banking as smooth as possible so that the client makes more transactions through more products using cheap facilities such as e-banking.

Profit maximisation

The integration between banking and insurance has seen financial institution profits sky-rocketing. These integrated financial institutions maximise profits through increased products and services offering, reduced cost and efficiency in information processing. Financial institutions invest a lot of funds in information search to avoid issues related to adverse selection. However, through integration information asymmetry can be reduced and the general research cost is lowed.

Increased market share

The advent of Allfinanz have seen increased market share, financial conglomerates managed to secure the largest percentage of the market. Due to convenience brought by bancassurance customers have the proclivity to subscribe to all their service with one provider. The one-stop centre of bancassurance has emerged to be the future of banking, coupled with the COVID:19 pandemic full- service financial firms have attracted more clients as customer process all their transactions under one roof.

Increased customer loyalty

The provision of all financial products by a singe institution witnessed an increase in brand loyalty for banks. Customers perceive banks that provide integrated services as secure and of a high standard. Bancassurance delivered quality products and value beyond the expectations of most clients. By tapping into a wide market share and reducing average cost, these hybrid financial institutions have managed to invest in powerful and high-speed computers systems which can improve information processing. Customers owe their trust in banks which provide them with a variety and reliable services.

Diversification

Instead of depending on net interest income and trading book activities, banks are smoothing their income by helping insurance companies reaching out to customers. Banks view the integration as a risk management technique in which they can secure some risky products on their balance sheet with the insurance products. For example, a bank providing a mortgage loan and is also providing an insurance service to clients, default by the mortgage holder, the bank can use the life insurance to pay for the remaining mortgage balance.

Economies of scale

As the bank market share increase, the average cost tends to diminish. Economies of scale come in different proportions and channels, information search, research and development and marketing costs will all diminish. To maintain quality service financially integrated institutions invest in capital intensive machines to avoid any potential operational risk. These modern systems and computers have reduced the wage bill in the banking sector, transactions can now be processed online without stepping into the banking room.

Disadvantages

Cannibalisation

The loss or decrease in overall sales for an institution following the release of a similar product in the portfolio. Pietro (2017) argued that cannibalisation is harmful to a firm it may shift customers` preferences from newly introduced products to older products. In a mathematical sense, cannibalisation defines a situation in which gain in one product is offset by a loss in another product. This ceases to be diversification because the intention to introduce a new product is not to move customers from one product to another. If banks fail to plan properly and structure their products cannibalisation is possible and will keep the bank revolve in one position whilst siphoning funds in research and product development.

Poor quality products

Financial institutions may end up focusing on service proliferation and ignore the supporting infrastructure to upkeep the new products. Due to the penchant with banks and insurance companies to attract as many subscribers as possible they usually fail to match their infrastructure with the potential demand which subsequently leads to poor quality products. Bank may become overwhelmed by too many products.

Bibliography

Johan, C., 2016. Bank Management in South Africa – A risk-based perspective. 1st ed. Bloemfontein: Juta Publishers.

Meenu, J., 2019. Advantages of Bancassurance for Customers, Banks & Insurance Carriers. 23 May.

Pietro, G., 2017. Product cannibalization and the effect of a service strategy. Journal of the Operational Research Society , 01 January, pp. 224-5.

Schüler, M., 2004. Integrated Financial Supervision in Germany. Leibniz Centre for European Economic Research, pp. W Discussion Papers, No. 04-35.