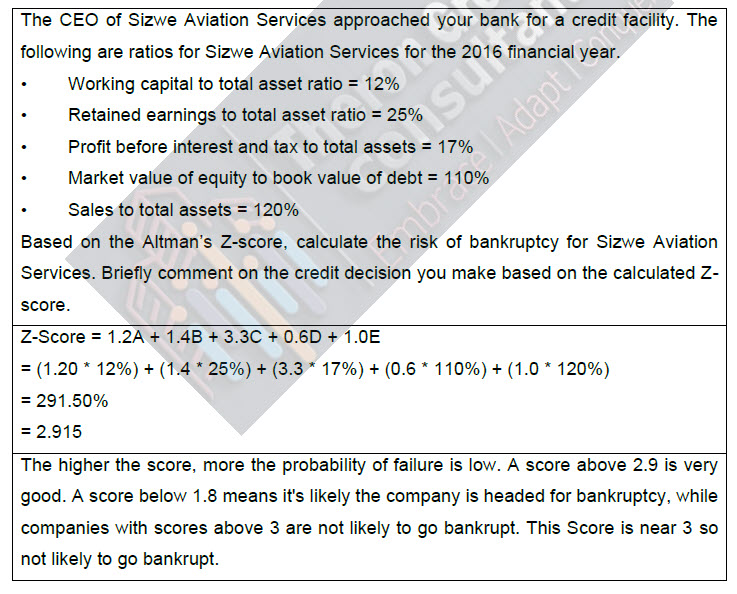

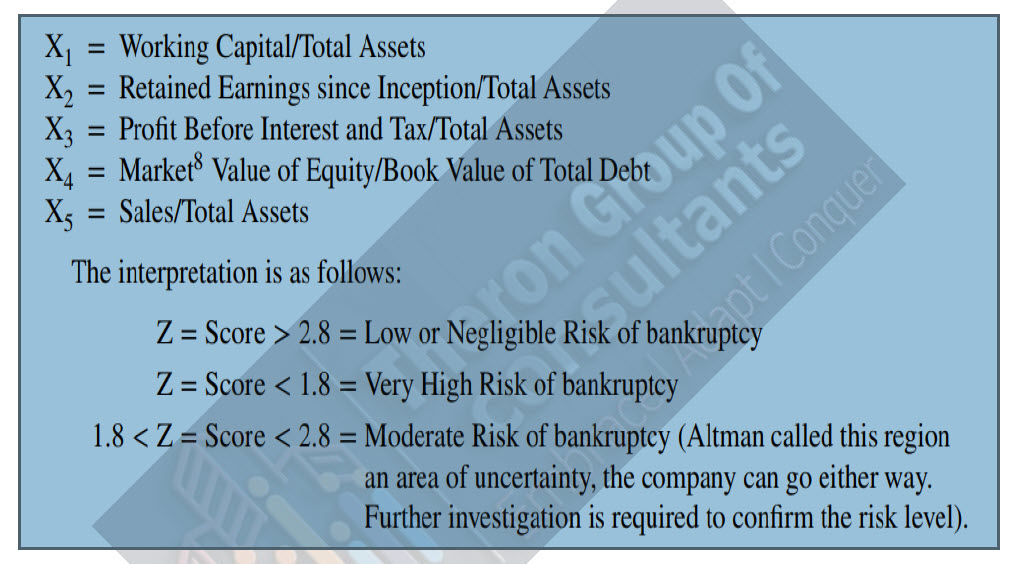

The Z-score formula for predicting bankruptcy was published in 1968. One of the perpetual worries of a creditor is the possibility of a borrower going broke. Several studies have been conducted in this area, among which Prof. Edward I Altman’s Z-Score Model is well known. Z-Score predicts the likelihood of a firm going bankrupt. Z-Score is calculated as given below:

According to Altman, the Z-Score can predict with 95% accuracy the risk of a business going bankrupt within a year and 72% within two years. Altman had studied 33 bankrupt firms along with a paired sample of 33 non-bankrupt firms and examined 22 ratios, based on which he identified the abovementioned five ratios.

The Z-Score has faced criticisms such as (a) being more useful in the US context, (b) use of total assets as the denominator, in three of the five ratios (a credit executive may exclude all intangible assets from total assets. Intangibles usually do not have value unless the firm is a going concern), (c) lack of emphasis on liquidity ratios, since it is the illiquidity that ultimately leads to bankruptcy or insolvency, (later researchers like Mr. Tafflan, evolved ratio based Bankruptcy Models emphasizing current assets and liabilities, but did not seem to act as any better indicator), (d) whilst 95% predictability one year ahead is fair enough, usually all troubled companies will publish the accounts quite late, reducing the practical use.

Despite these criticisms, ratio-based predictions are commonly used in the financial world. While certain ratios such as Altman’s, Tafflier, and LC Gupta are published, there are other models9 that remain proprietary and are not disclosed to the public. Z-score models are used routinely by most banks, financial institutions, and accountancy firms. They may be used to (i) get an idea of the probability of trouble ahead, (ii) track a company’s progress over time, and (iii) compare companies of similar sizes in the same sector of industry.