QUESTION

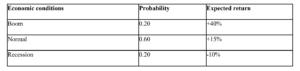

The following information relates to Netherton’s investment performance, during various economic conditions.

Required:

a) Calculate the expected return of this investment. (8)

b)Estimate the overall risk (standard deviation) of this investment. (7)

Solution

| Economic conditions | Probability | Expected return | Formula =Σ𝑬(𝑹𝑹) | Σ𝑬(𝑹𝑹) |

| Boom | 0.20 | +40% | (0.20×40) |

8+ |

| Normal | 0.60 | +15% | (0.60×15) |

9+ |

| Recession | 0.20 | -10% | [0.20x(-10)] |

-2 |

| Expected Return = |

15 |

|||

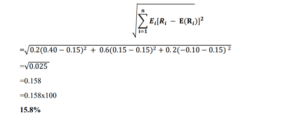

Investment Standard Deviation

thank you

please send me an another example

Regards

Jayarani

You are welcome.

Okay

https://blog.therongroup.org/correlation-coefficient/

https://blog.therongroup.org/expected-return-the-variance-and-standard-deviation/

JAYARANI MOODLEY

Kindly follow the links for more examples of portfolio theory.