- Zefer Ltd. has faced extreme financial difficulties over the past decade, however, the sales of safety gates that it manufactures are currently booming. The company however cannot meet demand due to liquidity constraints and is pondering a rights issue. Its shares are currently trading at 90c apiece and there are currently 1 billion shares outstanding. It is envisaged that the markets will react negatively to the rights issue and that the company would have to significantly under-price the rights to ensure a full subscription. The company plans to set a subscription price of 60c apiece. Zefer Ltd. wants to raise R50 million with its offer.

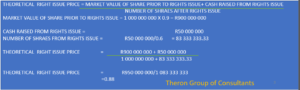

- What would be the theoretical value of a share of Zefer Ltd be after the rights issue if fully subscribed?

Solution