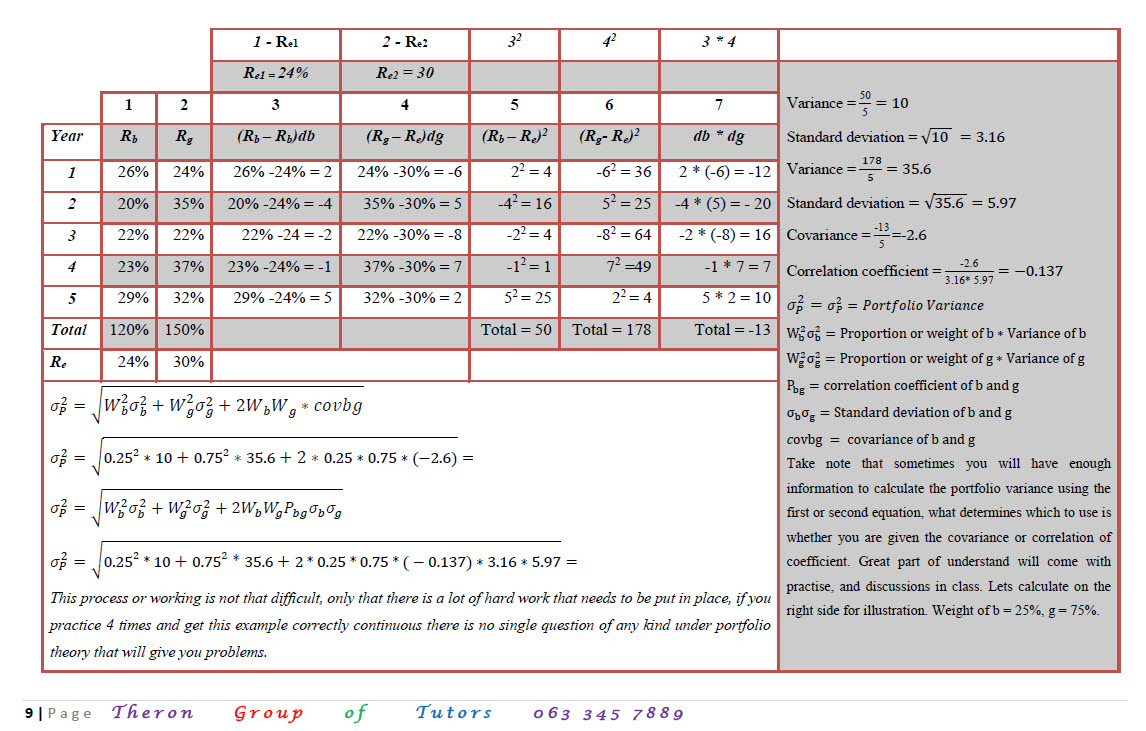

The example used here has been extracted from Correia et al (1993), for 5 years, Benix in the textile and clothing industry, had returns of 26%, 20%, 22%, 23%, 29%, while Genhold has returns of 24%, 35%, 22%, 37%, 32%. We will use this information to calculate the variance and standard deviation of the portfolio.

Knowledge Sharing