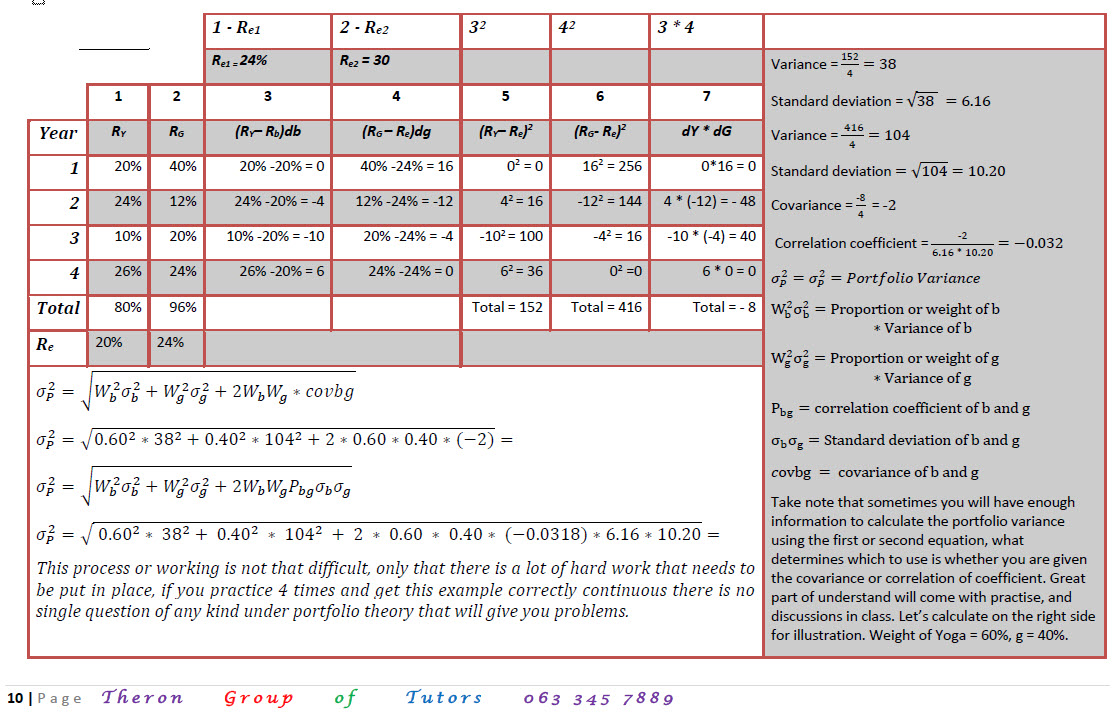

We have two investments, Investment Yoga and Investment gym. The returns for investment Yoga are 20%, 24%, 10% and 26%, while the returns for investment Gym are 40%, 12%, 20%, and 24%. Let’s use this information to calculate the population standard deviation of Yoga and population standard deviation of Gym, the covariance of Yoga and Gym, and thus the correlation coefficient between Yoga investment and Gym investment, remember with the table format used above.

Related Posts

Calculate the portfolios expected return.

- Unite Mahaso

- November 6, 2021

- 2 min read

- 0

Your bank has a portfolio of two assets to the value of R10, 000. Both […]

Capital Asset Pricing Model.

- Unite Mahaso

- September 30, 2021

- 3 min read

- 0

Capital Asset Pricing Model There are two basic functions associated with the CAPM, firstly establishing […]

Advantages of Retained Earnings

- Unite Mahaso

- September 30, 2021

- 1 min read

- 0

No formality requirements – the first advantage of using internally generated funds is that there […]

Shareholder Activism.

- Unite Mahaso

- March 8, 2021

- 6 min read

- 0

The role of shareholder activism in influencing the actions taken by the board and the […]