There are two main cash management models namely; Baumol’s model and the Miller-Orr model. Assumptions, advantages, and disadvantages of the models are discussed below.

- Baumol’s Model –this model is sometimes called the inventory model of cash management, mainly because it is related to the economic order quantity model used in inventory management. Baumol’s model is designed to minimize the total cost of fixed expenses for raising cash plus the opportunity cost of holding cash. Baumol model is based on the following assumptions;

- The rate at which the company uses cash is constant;

The cost of raising cash is independent of the amount of cash raised; - The opportunity cost of holding cash is the interest rate that does not vary with the level of cash held, (interest rate will remain constant even if the cash balance is negative).

Since the above assumptions of the Baumol model do not hold true in practice the applicability of the Baumol model is limited.

- Miller-Orr model – this model was developed to produce a more useful model than the Baumol model. The Miller-Orr model sets an upper and lower limit to the level of cash that the organization has to hold. When these levels are reached the firm should either buy or sell short-term marketable securities to check the cash levels. To set these levels, the variability of cash flows needs to be determined along with the costs of buying and selling securities and the interest rate. There are five steps that are used in calculating the Miller-Orr model. These steps are discussed below:

- Determine the lower level of cash the firm is comfortable having. This is the minimum safety level, which in theory could be zero.

- Determine the variance of the firm’s cash flows over a period of time (for instance over three or six months).

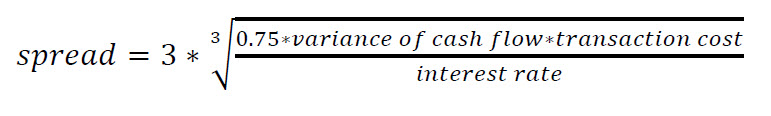

- Calculate the spread of transactions, using the following formula:

- Calculate the upper limit – this is the lower limit plus the spread.

- Calculate the return point. The return point is the lower limit plus 1/3∗𝑠𝑝𝑟𝑒𝑎𝑑. In an equation, the return point can be calculated using the following equation: 𝑟𝑒𝑡𝑢𝑟𝑛 𝑝𝑜𝑖𝑛𝑡=𝑙𝑜𝑤𝑒𝑟 𝑙𝑖𝑚𝑖𝑡+ 1/3∗𝑠𝑝𝑟𝑒𝑎𝑑